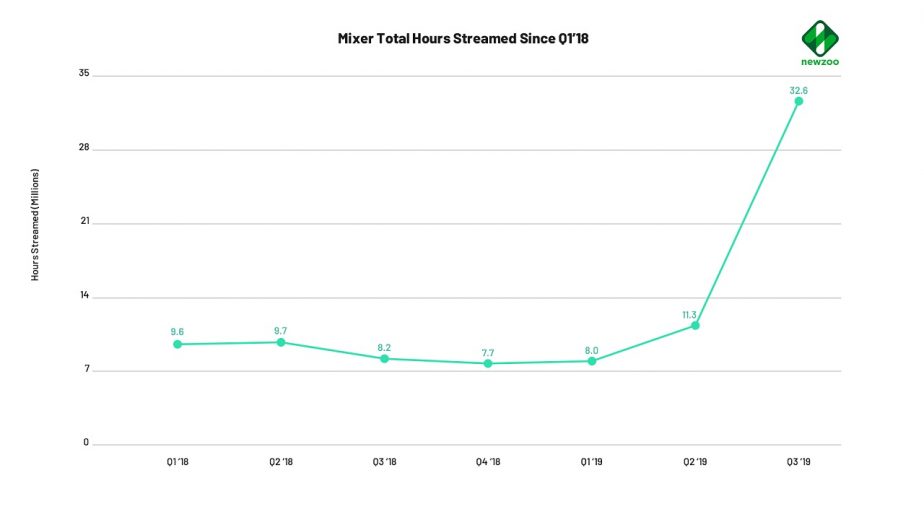

Earlier this year, Ninja surprised many of his fans when he announced an exclusive partnership with Mixer, Microsoft’s official streaming platform. Despite its ease of use on Xbox, Mixer has long been in a distant third place when it comes to the streaming industry, behind YouTube Live and Twitch. In fact, data revealed last quarter showed that DLive had overtaken Mixer as well. However, the latest quarterly report from StreamLabs reveals that Ninja’s move seems to have begun a huge surge for Mixer.

Twitch’s Decline Continues in Q3

While previous quarterly reports released by StreamLabs have included all manner of streaming content, the new Q3 2019 report only includes gaming content, with data provided by Newzoo. “Data for YouTube Gaming Live only includes gaming live streams,” explains StreamLabs; “In order to create a more accurate comparison between platforms, we have excluded non-gaming content for Twitch and Mixer from this report.”

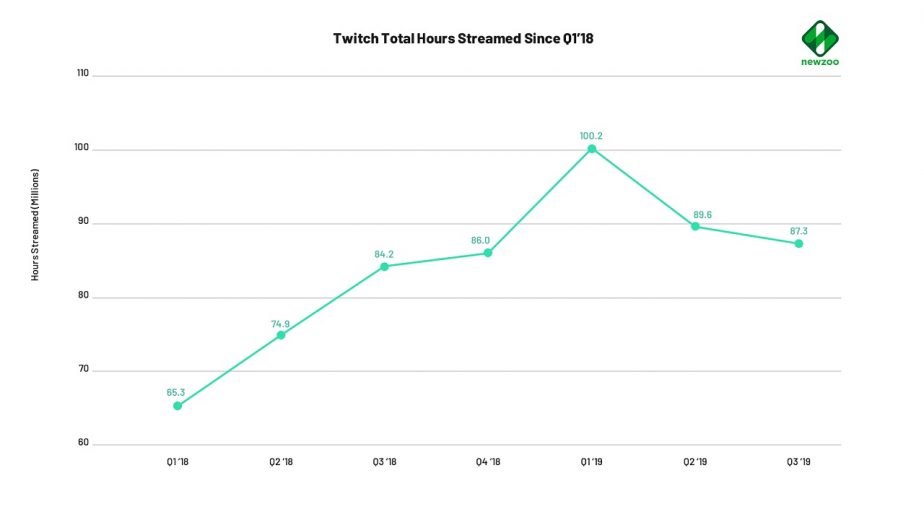

Back in Q2 2019, Twitch saw a sudden decline in the number of hours streamed, and that figure has continued to fall in Q3, though less precipitously. 87.3 million hours were streamed this quarter, compared to 89.6 in Q2 and 100.2 in Q1. Interestingly, the number of unique channels on Twitch is also dropping, and has declined at a steady rate since Q1 by around 32%. There are now 3.77 million unique channels, as opposed to 5.6 million in Q1. While this does indicate a continuing decline for Twitch, the platform does still sit far ahead of its competitors. However, when we look at the Mixer data, it seems likely that Ninja’s departure has led to a migration of sorts, though possibly more for streamers than viewers.

The Massive Surge for Mixer Streaming in Q3 2019

Overall, the total hours watched on Mixer actually fell by 10.6% in Q3 from Q2, down from 100.9 million to 90.2 million. This is still a huge increase from Q3 2018, but it does suggest that Ninja’s move hasn’t led to a significant increase for viewership. Where it does seem to have caused a move is in other streamers; the amount of hours streamed on Mixer has surged upwards in Q3, with a 188% increase in this quarter alone. This amounts to a rise from 11.3 million hours all the way up to 32.6 million hours! The number of unique channels has also doubled from 1.95 million to 3.9 million. After seeing Ninja make the move to Mixer, it seems that other streamers have chosen to make the move as well; no doubt hoping that Ninja’s move would attract more viewers to the platform.

Thus far, however, that move doesn’t appear to have materialised. However, if this trend continues, it is possible that the audience may begin to shift in Q4. Ninja is certainly a major name, and if more streamers continue to follow his lead, the availablility of content on the platform could start to bring more viewers across as well. For now, however, the average number of viewers per channel has dropped from 8.9 to just 2.7. (Though this is primarily due to the sudden influx of new channels, noted above.) When it comes to average viewers per channel, YouTube Gaming Live remains the strongest platform.

YouTube Gaming Live in Q3 Remains Stable

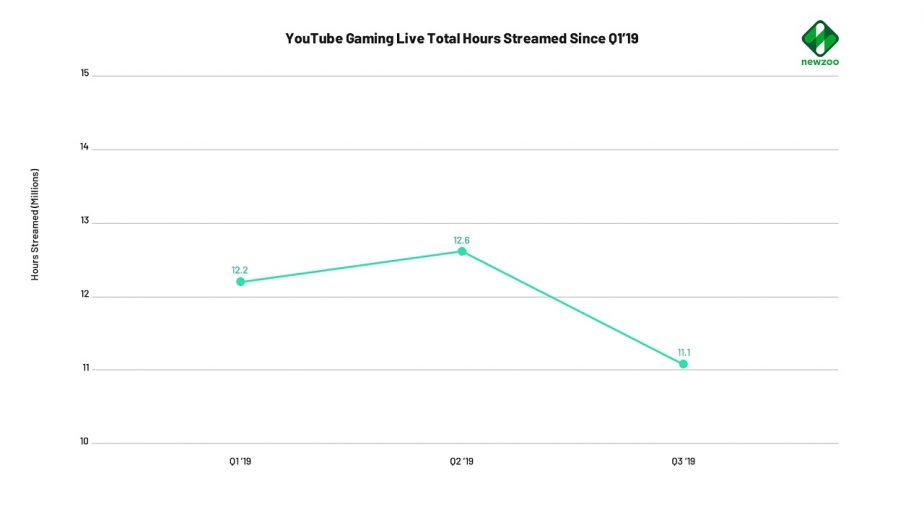

YouTube Gaming Live has remained relatively stable throughout Q3. The total hours watched figure has dropped very slightly, although this does end their significant Q2 growth. The figure rose from 622.4 million hours in Q1 to 677.2 in Q2. Now, it has dropped back down to 675.9 hours watched. The number of hours streamed, meanwhile, also dropped from 12.6 million to 11.1 million; their lowest figure in 2019. This may suggest that some YouTube streamers have been among those who made the move over to Mixer. However, this does also mean that the number of average viewers per channel has gone up from 53.7 to 61. This is now more than double that of Twitch, which has an average number of viewers per channel of 28.2.

Overall, the Q3 2019 data hasn’t generally changed the landscape of the streaming industry. Twitch remains far out in front, with YouTube in the centre, and Mixer behind. However, we could be seeing the beginning of several new trends, most notably in Mixer. Q3 has seen the first major move from content creators onto the platform. If that trend continues in Q4 and begins to attract a larger shift from the viewing audience, Mixer’s position in the industry could certainly start to rise.

However, if viewing figures don’t pick up in Q4, many of those streamers who moved to the platform may choose to leave. This could end up quashing the trend before it builds momentum. Similarly, Twitch and YouTube may step up their promotional efforts in Q4 as they see their figures start to trend downwards. If so, they could attract back some of those who moved to Mixer. Certainly, it will be interesting to see whether either of the two platforms start to offer extra incentives for content creators. Or, indeed, whether Mixer starts to promote their own platform more widely to encourage their new streamers to stay.